Companies using MSCI Indexes

We have data on 24 companies that use MSCI Indexes. The companies using MSCI Indexes are most often found in United States and in the Financial Services industry. MSCI Indexes is most often used by companies with >10000 employees and >1000M dollars in revenue. Our data for MSCI Indexes usage goes back as far as 8 months.

If you’re interested in the companies that use MSCI Indexes, you may want to check out Square and PeopleSoft as well.

Who uses MSCI Indexes?

| Company | Cognizant Technology Solutions Corp |

| Website | cognizant.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Morgan Stanley |

| Website | morganstanley.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | HSBC Holdings PLC |

| Website | hsbc.com |

| Country | United Kingdom |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Citigroup Inc |

| Website | citigroup.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Evalueserve |

| Website | evalueserve.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | 5000-10000 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| Cognizant Technology Solutions Corp | cognizant.com | United States | >1000M | >10000 |

| Morgan Stanley | morganstanley.com | United States | >1000M | >10000 |

| HSBC Holdings PLC | hsbc.com | United Kingdom | >1000M | >10000 |

| Citigroup Inc | citigroup.com | United States | >1000M | >10000 |

| Evalueserve | evalueserve.com | United States | >1000M | 5000-10000 |

Target MSCI Indexes customers to accomplish your sales and marketing goals.

MSCI Indexes Market Share and Competitors in Financial Management

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Financial Management. By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Financial Management category, MSCI Indexes has a market share of about 0.1%. Other major and competing products in this category include:

Financial Management

What is MSCI Indexes?

MSCI Indexes offers a suite of indexes for portfolios such as market cap, ESG (Environmental, Social and Governance), climate, fixed income, direct indexing and more. MSCI factor indexes are rules-based indexes that capture the returns of systematic factors that have historically earned a persistent premium over long periods of time such as value, low size, low volatility, high yield, quality and momentum and growth. MSCI market cap indexes provides a suite of large, mid and small cap indexes that is designed to accurately represent and measure global equity markets as they evolve, meeting a wide range of changing investor needs within a single framework.

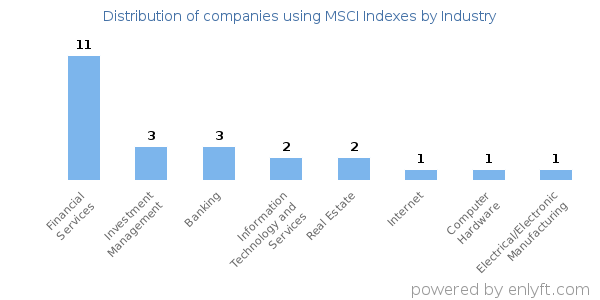

Top Industries that use MSCI Indexes

Looking at MSCI Indexes customers by industry, we find that Financial Services (42%), Investment Management (9%) and Banking (9%) are the largest segments.

Top Countries that use MSCI Indexes

38% of MSCI Indexes customers are in United States and 13% are in United Kingdom.

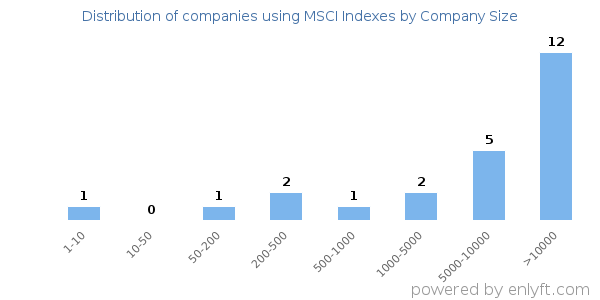

Distribution of companies that use MSCI Indexes based on company size (Employees)

Of all the customers that are using MSCI Indexes, a majority (68%) are large (>1000 employees), 1% are small (<50 employees) and 7% are medium-sized.

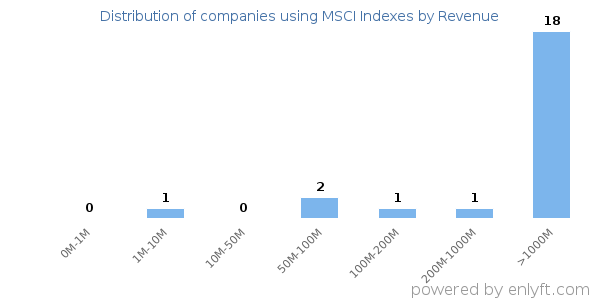

Distribution of companies that use MSCI Indexes based on company size (Revenue)

Of all the customers that are using MSCI Indexes, a majority (72%) are large (>$1000M), 0% are small (<$50M) and 0% are medium-sized.