Companies using MSCI BarraOne

We have data on 28 companies that use MSCI BarraOne. The companies using MSCI BarraOne are most often found in United States and in the Financial Services industry. MSCI BarraOne is most often used by companies with 1000-5000 employees and >1000M dollars in revenue. Our data for MSCI BarraOne usage goes back as far as 9 months.

If you’re interested in the companies that use MSCI BarraOne, you may want to check out Square and PeopleSoft as well.

Who uses MSCI BarraOne?

| Company | JPMorgan Chase & Co. |

| Website | jpmorganchase.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Wells Fargo & Company |

| Website | wellsfargo.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | LPL Financial Holdings Inc |

| Website | lpl.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | 5000-10000 |

| Company | AllianceBernstein L.P. |

| Website | alliancebernstein.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | 1000-5000 |

| Company | NuWare |

| Website | nuware.com |

| Country | United States |

| Revenue | 200M-1000M |

| Company Size | 200-500 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| JPMorgan Chase & Co. | jpmorganchase.com | United States | >1000M | >10000 |

| Wells Fargo & Company | wellsfargo.com | United States | >1000M | >10000 |

| LPL Financial Holdings Inc | lpl.com | United States | >1000M | 5000-10000 |

| AllianceBernstein L.P. | alliancebernstein.com | United States | >1000M | 1000-5000 |

| NuWare | nuware.com | United States | 200M-1000M | 200-500 |

Target MSCI BarraOne customers to accomplish your sales and marketing goals.

MSCI BarraOne Market Share and Competitors in Financial Management

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Financial Management. By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Financial Management category, MSCI BarraOne has a market share of about 0.1%. Other major and competing products in this category include:

Financial Management

What is MSCI BarraOne?

MSCI BarraOne is a single platform for multi-asset class investment risk management and performance attribution. It offers risk and portfolio managers multiple views of risk allowing them to manage global, multi-asset class portfolios. It helps users to identify and quantify the sources of investment risk across multiple asset classes, strategies and markets. It is used to unify asset and portfolio analytics across the firm by computing asset and portfolio-level measures using a consistent model.

Top Industries that use MSCI BarraOne

Looking at MSCI BarraOne customers by industry, we find that Financial Services (47%) and Investment Management (26%) are the largest segments.

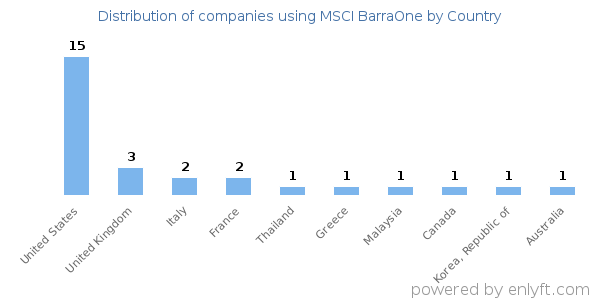

Top Countries that use MSCI BarraOne

50% of MSCI BarraOne customers are in United States and 8% are in United Kingdom.

Distribution of companies that use MSCI BarraOne based on company size (Employees)

Of all the customers that are using MSCI BarraOne, a majority (74%) are large (>1000 employees), 1% are small (<50 employees) and 8% are medium-sized.

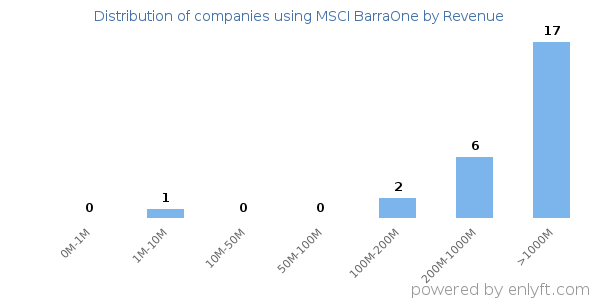

Distribution of companies that use MSCI BarraOne based on company size (Revenue)

Of all the customers that are using MSCI BarraOne, a majority (79%) are large (>$1000M), 0% are small (<$50M) and 5% are medium-sized.