Companies using LoansPQ

We have data on 228 companies that use LoansPQ. The companies using LoansPQ are most often found in United States and in the Banking industry. LoansPQ is most often used by companies with 50-200 employees and 10M-50M dollars in revenue. Our data for LoansPQ usage goes back as far as 5 years and 4 months.

If you’re interested in the companies that use LoansPQ, you may want to check out CoreCard Software and Calyx Software as well.

Who uses LoansPQ?

| Company | Trellance |

| Website | trellance.com |

| Country | United States |

| Revenue | 50M-100M |

| Company Size | 200-500 |

| Company | Randstad N.V. |

| Website | randstad.com |

| Country | Netherlands |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Community Bank System |

| Website | cbna.com |

| Country | United States |

| Revenue | 200M-1000M |

| Company Size | 1000-5000 |

| Company | MeridianLink |

| Website | meridianlink.com |

| Country | United States |

| Revenue | 200M-1000M |

| Company Size | 500-1000 |

| Company | JPMorgan Chase & Co. |

| Website | jpmorganchase.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| Trellance | trellance.com | United States | 50M-100M | 200-500 |

| Randstad N.V. | randstad.com | Netherlands | >1000M | >10000 |

| Community Bank System | cbna.com | United States | 200M-1000M | 1000-5000 |

| MeridianLink | meridianlink.com | United States | 200M-1000M | 500-1000 |

| JPMorgan Chase & Co. | jpmorganchase.com | United States | >1000M | >10000 |

Target LoansPQ customers to accomplish your sales and marketing goals.

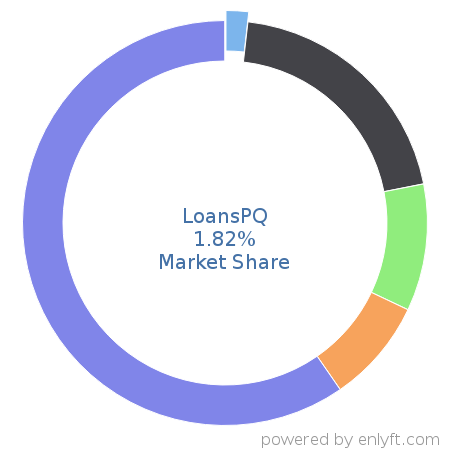

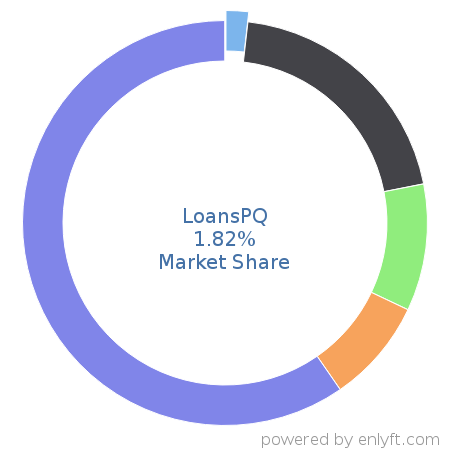

LoansPQ Market Share and Competitors in Loan Management

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Loan Management. By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Loan Management category, LoansPQ has a market share of about 1.8%. Other major and competing products in this category include:

Loan Management

What is LoansPQ?

LoansPQ is the industry-leading loan origination system that ensures a frictionless experience by easily consolidating data from all existing channels - mobile, online, branch, call center, indirect, retail, and kiosk - into a single origination point. With over 1,000 configuration points, 200 third-party integrations, a robust underwriting and pricing engine, full loan product suite support and a configurable dynamic workflow engine, LoansPQ can be tailored to fit the needs of any financial institution.

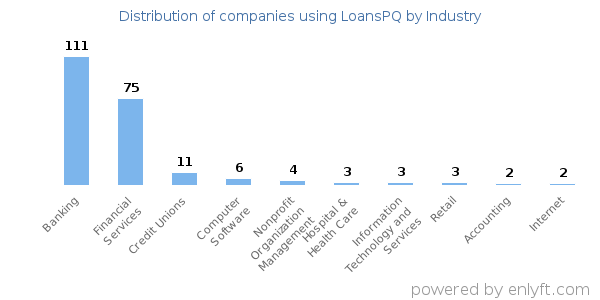

Top Industries that use LoansPQ

Looking at LoansPQ customers by industry, we find that Banking (44%) and Financial Services (31%) are the largest segments.

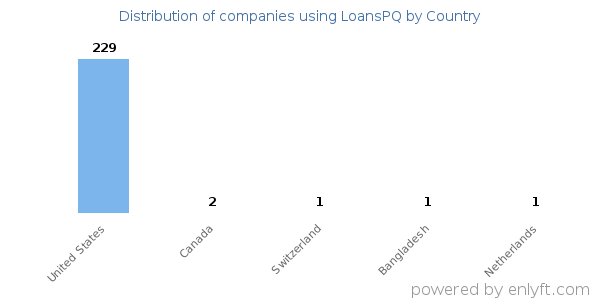

Top Countries that use LoansPQ

96% of LoansPQ customers are in United States.

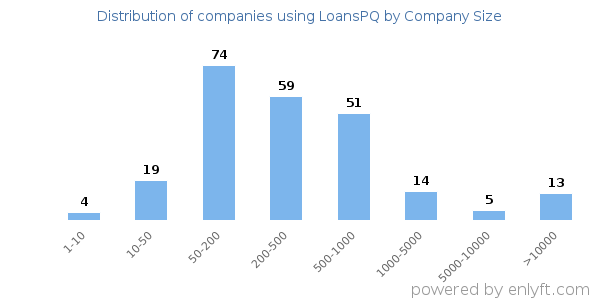

Distribution of companies that use LoansPQ based on company size (Employees)

Of all the customers that are using LoansPQ, a majority (74%) are medium-sized, 13% are large ( >1000 employees) and 9 are small (<50 employees).

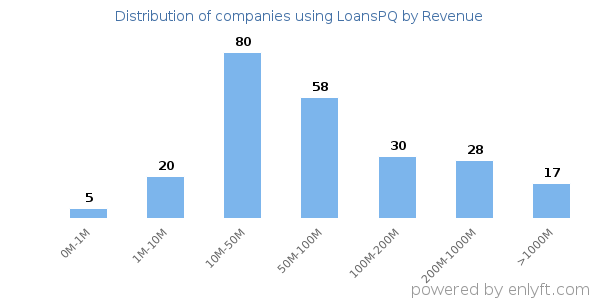

Distribution of companies that use LoansPQ based on company size (Revenue)

Of all the customers that are using LoansPQ, 42% are small (<$50M), 34% are medium-sized and 20% are large (>$1000M).