Companies using FusionRisk

We have data on 35 companies that use FusionRisk. The companies using FusionRisk are most often found in United States and in the Banking industry. FusionRisk is most often used by companies with >10000 employees and >1000M dollars in revenue. Our data for FusionRisk usage goes back as far as 7 years and 6 months.

Who uses FusionRisk?

| Company | Accenture PLC |

| Website | accenture.com |

| Country | Ireland |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Tata Consultancy Services Ltd |

| Website | tcs.com |

| Country | India |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Fidelity Brokerage Services LLC |

| Website | fidelity.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Deutsche Kreditbank AG (DKB) |

| Website | dkb.de |

| Country | Germany |

| Revenue | >1000M |

| Company Size | 1000-5000 |

| Company | Trans Union LLC |

| Website | transunion.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| Accenture PLC | accenture.com | Ireland | >1000M | >10000 |

| Tata Consultancy Services Ltd | tcs.com | India | >1000M | >10000 |

| Fidelity Brokerage Services LLC | fidelity.com | United States | >1000M | >10000 |

| Deutsche Kreditbank AG (DKB) | dkb.de | Germany | >1000M | 1000-5000 |

| Trans Union LLC | transunion.com | United States | >1000M | >10000 |

Target FusionRisk customers to accomplish your sales and marketing goals.

FusionRisk Market Share and Competitors in Enterprise Resource Planning (ERP)

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Enterprise Resource Planning (ERP). By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Enterprise Resource Planning (ERP) category, FusionRisk has a market share of about 0.1%. Other major and competing products in this category include:

Enterprise Resource Planning (ERP)

What is FusionRisk?

FusionRisk is designed to eliminate the need for compromise: Misys FusionRisk is helping to see risk, by bringing up-to-date risk figures, analysis and optimisation tools to key decision makers. Credit, market and liquidity risk can be analysed from one place, and regulatory capital, liquidity coverage ratios and stress tests can be managed to alleviate regulatory pressures.

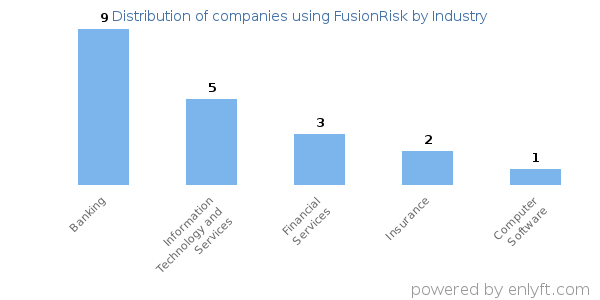

Top Industries that use FusionRisk

Looking at FusionRisk customers by industry, we find that Banking (29%), Information Technology and Services (15%), Financial Services (9%), Computer Software (6%) and Insurance (6%) are the largest segments.

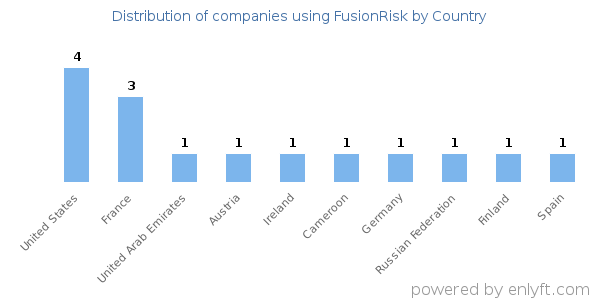

Top Countries that use FusionRisk

43% of FusionRisk customers are in United States, 9% are in France and 6% are in United Kingdom.

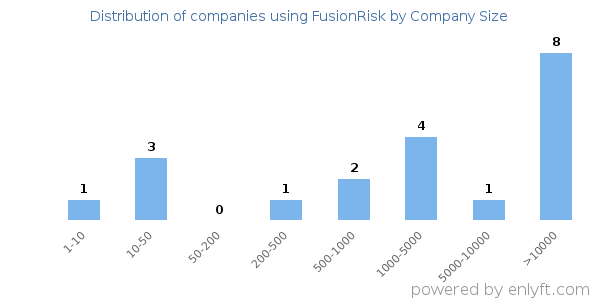

Distribution of companies that use FusionRisk based on company size (Employees)

Of all the customers that are using FusionRisk, a majority (65%) are large (>1000 employees), 6% are small (<50 employees) and 9% are medium-sized.

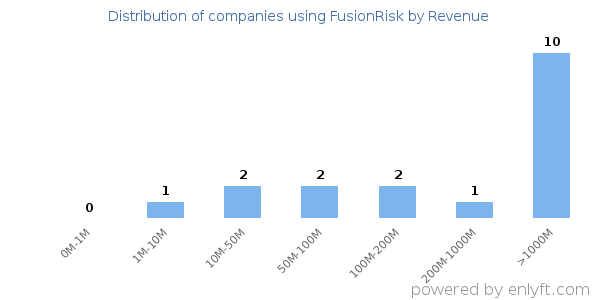

Distribution of companies that use FusionRisk based on company size (Revenue)

Of all the customers that are using FusionRisk, a majority (66%) are large (>$1000M), 0% are small (<$50M) and 7% are medium-sized.