Companies using Charles River IMS

We have data on 61 companies that use Charles River IMS. The companies using Charles River IMS are most often found in United States and in the Financial Services industry. Charles River IMS is most often used by companies with >10000 employees and >1000M dollars in revenue. Our data for Charles River IMS usage goes back as far as 9 months.

If you’re interested in the companies that use Charles River IMS, you may want to check out Square and PeopleSoft as well.

Who uses Charles River IMS?

| Company | Wipro Ltd |

| Website | wipro.com |

| Country | India |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Ernst & Young Global Limited |

| Website | ey.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Scotiabank |

| Website | scotiabank.com |

| Country | Canada |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | T. Rowe Price Group, Inc. |

| Website | troweprice.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | 5000-10000 |

| Company | HCL Infosystems Ltd. |

| Website | hclinfosystems.com |

| Country | India |

| Revenue | 200M-1000M |

| Company Size | >10000 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| Wipro Ltd | wipro.com | India | >1000M | >10000 |

| Ernst & Young Global Limited | ey.com | United States | >1000M | >10000 |

| Scotiabank | scotiabank.com | Canada | >1000M | >10000 |

| T. Rowe Price Group, Inc. | troweprice.com | United States | >1000M | 5000-10000 |

| HCL Infosystems Ltd. | hclinfosystems.com | India | 200M-1000M | >10000 |

Target Charles River IMS customers to accomplish your sales and marketing goals.

Charles River IMS Market Share and Competitors in Financial Management

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Financial Management. By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Financial Management category, Charles River IMS has a market share of about 0.1%. Other major and competing products in this category include:

Financial Management

What is Charles River IMS?

Charles River IMS (Charles River Investment Management Solution) is an investment management solution that automates front and middle office processes for buy-side firms. It helps enable accurate and timely investment decision support for institutional and wealth managers, alternative investment firms, insurers and asset owners. It aslo helps clients streamline operations, reduce risk and improve reliability. It supports the entire investment lifecycle on a single platform, from portfolio and risk management through trading and post-trade settlement with integrated compliance management throughout. An Investment Book of Record (IBOR) provides real-time cash and position data and Charles River's Enterprise Data Management solution (EDM) helps firms improve the accuracy, consistency and completeness of their reference, analytics, pricing and benchmark data.

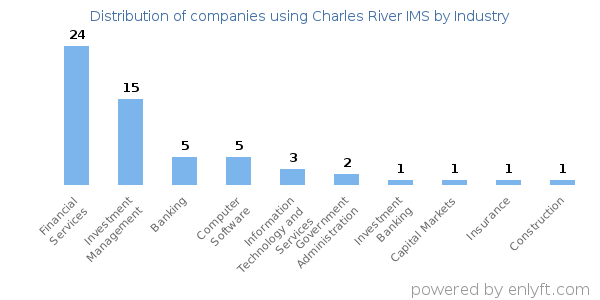

Top Industries that use Charles River IMS

Looking at Charles River IMS customers by industry, we find that Financial Services (38%), Investment Management (23%), Banking (7%) and Computer Software (7%) are the largest segments.

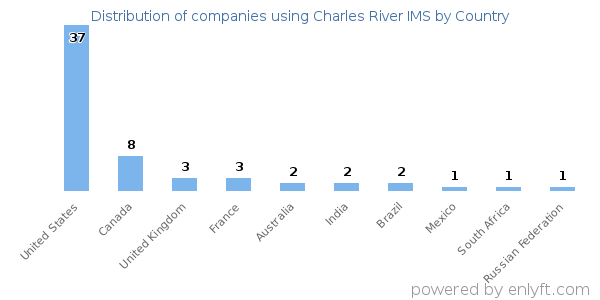

Top Countries that use Charles River IMS

59% of Charles River IMS customers are in United States and 12% are in Canada.

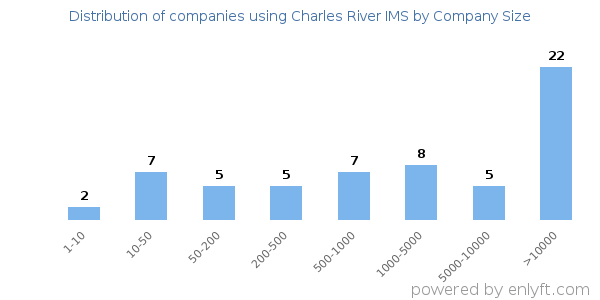

Distribution of companies that use Charles River IMS based on company size (Employees)

Of all the customers that are using Charles River IMS, a majority (54%) are large (>1000 employees), 12% are small (<50 employees) and 24% are medium-sized.

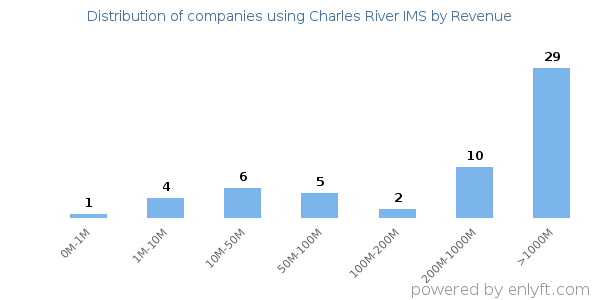

Distribution of companies that use Charles River IMS based on company size (Revenue)

Of all the customers that are using Charles River IMS, a majority (63%) are large (>$1000M), 15% are small (<$50M) and 7% are medium-sized.