Companies using Charles River Development

We have data on 303 companies that use Charles River Development. The companies using Charles River Development are most often found in United States and in the Financial Services industry. Charles River Development is most often used by companies with >10000 employees and >1000M dollars in revenue. Our data for Charles River Development usage goes back as far as 9 years and 3 months.

If you’re interested in the companies that use Charles River Development, you may want to check out CoreCard Software and Misys as well.

Who uses Charles River Development?

| Company | Accenture PLC |

| Website | accenture.com |

| Country | Ireland |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Infosys Ltd |

| Website | infosys.com |

| Country | India |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Ernst & Young Global Limited |

| Website | ey.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Scotiabank |

| Website | scotiabank.com |

| Country | Canada |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Tata Consultancy Services Ltd |

| Website | tcs.com |

| Country | India |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| Accenture PLC | accenture.com | Ireland | >1000M | >10000 |

| Infosys Ltd | infosys.com | India | >1000M | >10000 |

| Ernst & Young Global Limited | ey.com | United States | >1000M | >10000 |

| Scotiabank | scotiabank.com | Canada | >1000M | >10000 |

| Tata Consultancy Services Ltd | tcs.com | India | >1000M | >10000 |

Target Charles River Development customers to accomplish your sales and marketing goals.

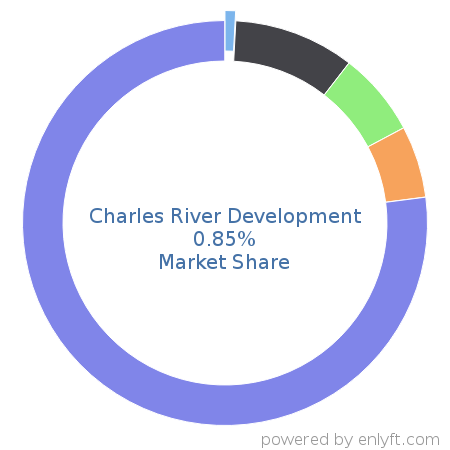

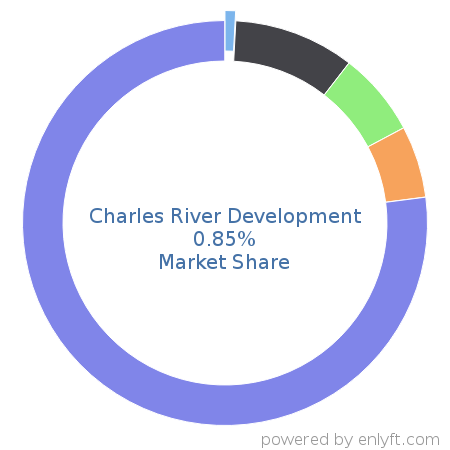

Charles River Development Market Share and Competitors in Banking & Finance

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Banking & Finance. By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Banking & Finance category, Charles River Development has a market share of about 0.8%. Other major and competing products in this category include:

Banking & Finance

What is Charles River Development?

Charles River provides an end-to-end solution to automate front- and middle-office investment management functions across asset classes on a single platform. Delivered as a hosted service, the solution offers a simplified operating model that improves data quality and investment professional productivity, controls risk and lowers technology costs. Charles River serves more than 350 investment firms in 44 countries in the institutional asset and fund management, private wealth, alternative investments, insurance, banking, and pension markets.

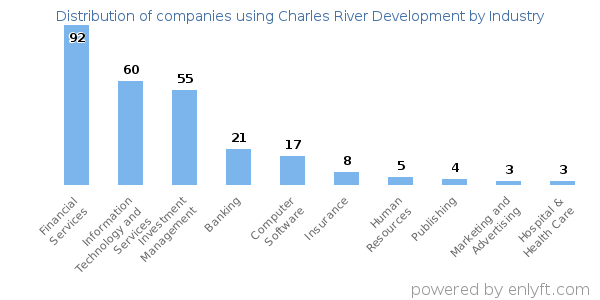

Top Industries that use Charles River Development

Looking at Charles River Development customers by industry, we find that Financial Services (24%), Information Technology and Services (19%), Investment Management (15%), Banking (7%) and Computer Software (5%) are the largest segments.

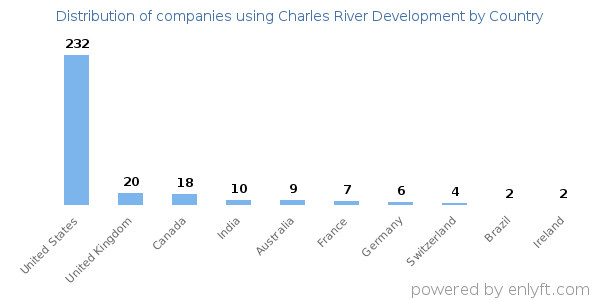

Top Countries that use Charles River Development

67% of Charles River Development customers are in United States, 7% are in United Kingdom and 6% are in Canada.

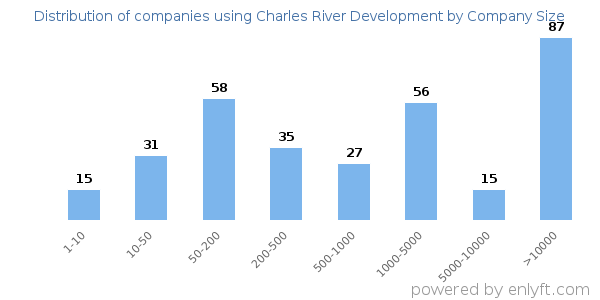

Distribution of companies that use Charles River Development based on company size (Employees)

Of all the customers that are using Charles River Development, 14% are small (<50 employees), 37% are medium-sized and 47% are large (>1000 employees).

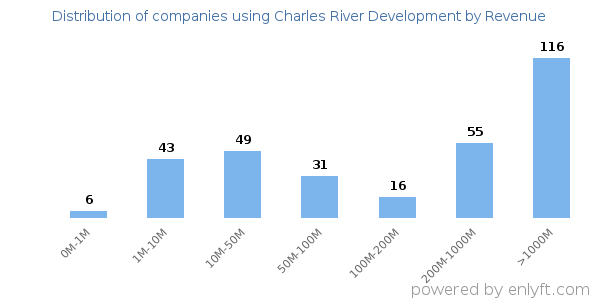

Distribution of companies that use Charles River Development based on company size (Revenue)

Of all the customers that are using Charles River Development, a majority (51%) are large (>$1000M), 28% are small (<$50M) and 16% are medium-sized.