Companies using Blend

We have data on 11 companies that use Blend. The companies using Blend are most often found in United States and in the Financial Services industry. Blend is most often used by companies with 1000-5000 employees and 50M-100M dollars in revenue. Our data for Blend usage goes back as far as 4 years and 10 months.

If you’re interested in the companies that use Blend, you may want to check out CoreCard Software and Calyx Software as well.

Who uses Blend?

| Company | Mortgage Advice Bureau |

| Website | mortgageadvicebureau.com |

| Country | United Kingdom |

| Revenue | 200M-1000M |

| Company Size | 1000-5000 |

| Company | The Federal Savings Bank |

| Website | thefederalsavingsbank.com |

| Country | United States |

| Revenue | 200M-1000M |

| Company Size | 1000-5000 |

| Company | Canadian Imperial Bank of Commerce |

| Website | cibc.com |

| Country | Canada |

| Revenue | >1000M |

| Company Size | >10000 |

| Company | UMB Financial |

| Website | umb.com |

| Country | United States |

| Revenue | >1000M |

| Company Size | 1000-5000 |

| Company | Dice |

| Website | dice.com |

| Country | United States |

| Revenue | 50M-100M |

| Company Size | 500-1000 |

| Company | Website | Country | Revenue | Company Size |

|---|---|---|---|---|

| Mortgage Advice Bureau | mortgageadvicebureau.com | United Kingdom | 200M-1000M | 1000-5000 |

| The Federal Savings Bank | thefederalsavingsbank.com | United States | 200M-1000M | 1000-5000 |

| Canadian Imperial Bank of Commerce | cibc.com | Canada | >1000M | >10000 |

| UMB Financial | umb.com | United States | >1000M | 1000-5000 |

| Dice | dice.com | United States | 50M-100M | 500-1000 |

Target Blend customers to accomplish your sales and marketing goals.

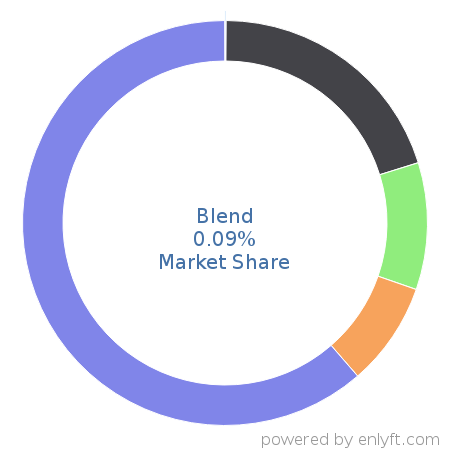

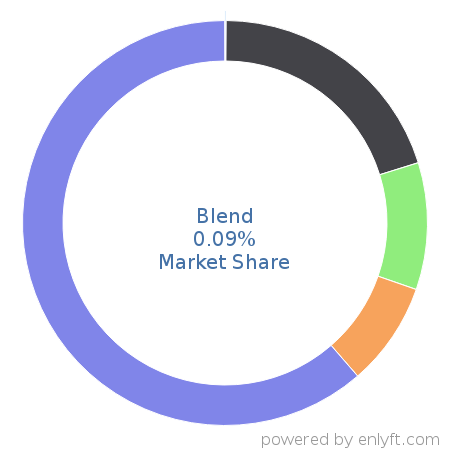

Blend Market Share and Competitors in Loan Management

We use the best indexing techniques combined with advanced data science to monitor the market share of over 15,000 technology products, including Loan Management. By scanning billions of public documents, we are able to collect deep insights on every company, with over 100 data fields per company at an average. In the Loan Management category, Blend has a market share of about 0.1%. Other major and competing products in this category include:

Loan Management

What is Blend?

Blend is an AI (Artificial Intelligence) based digital lending platform for mortgages and consumer banking. It uses a conversational interface, embedded services to leverage consumer data and user-centered design to maximize pull-through rates. It also verifies the data to reduce the risk of fraud and analyzes application data, identify issues that could cause delays, automate resolution tasks and drive predictive conditioning.

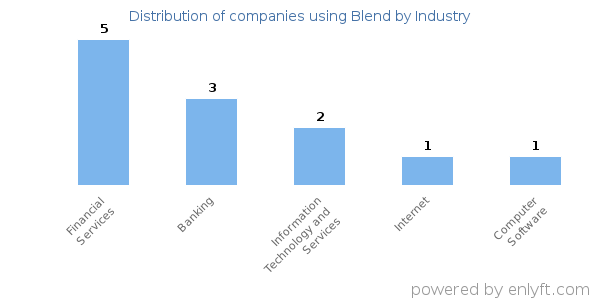

Top Industries that use Blend

Looking at Blend customers by industry, we find that Financial Services (39%), Banking (20%) and Information Technology and Services (11%) are the largest segments.

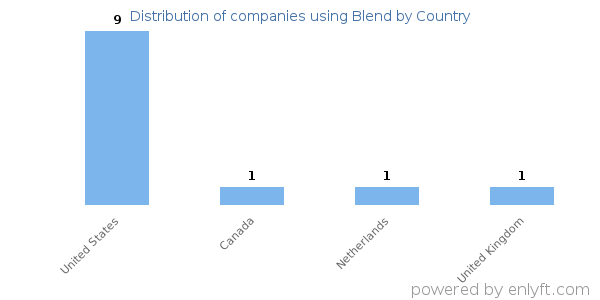

Top Countries that use Blend

66% of Blend customers are in United States.

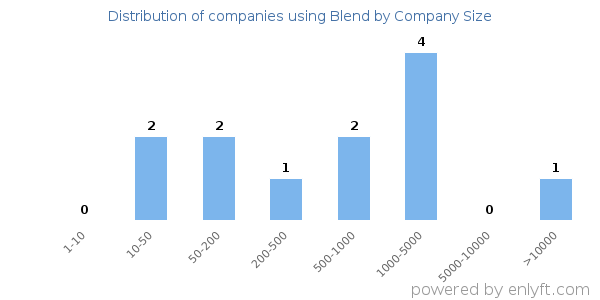

Distribution of companies that use Blend based on company size (Employees)

Of all the customers that are using Blend, 11% are small (<50 employees), 24% are medium-sized and 22% are large (>1000 employees).

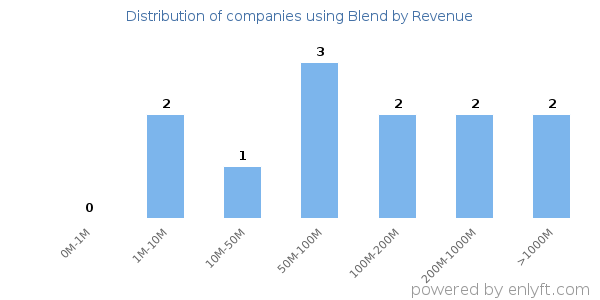

Distribution of companies that use Blend based on company size (Revenue)

Of all the customers that are using Blend, 11% are small (<$50M), 20% are medium-sized and 22% are large (>$1000M).